Comprehensive Private Wealth Management Near Me: How to Vet an Elite Advisor sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality. It delves into the intricacies of private wealth management, guiding individuals on selecting the best wealth advisor and understanding fee structures.

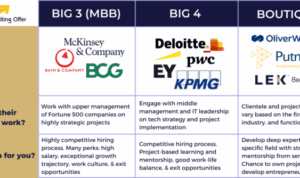

Understanding Private Wealth Management

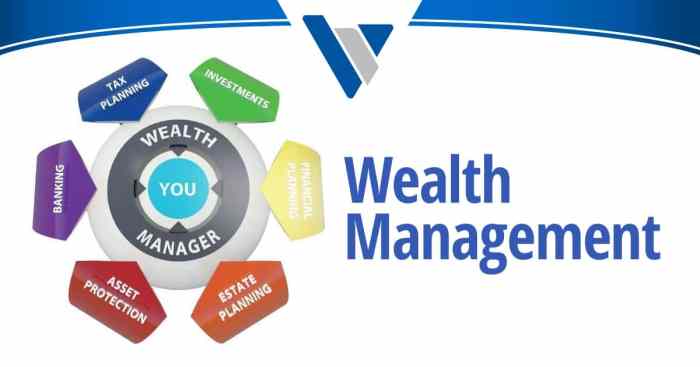

Private wealth management refers to the professional management of an individual's finances, investments, and other assets. It is a comprehensive approach that takes into account the unique financial goals and circumstances of each client.Key Services Offered by Private Wealth Managers

Private wealth managers provide a range of services tailored to meet the specific needs of high-net-worth individuals. Some key services include:- Investment management: Developing personalized investment strategies based on risk tolerance, financial goals, and time horizon.

- Financial planning: Creating a comprehensive financial plan that encompasses budgeting, retirement planning, tax planning, and estate planning.

- Risk management: Identifying and mitigating potential risks to the client's financial well-being through insurance and other strategies.

- Asset protection: Safeguarding assets from creditors and other potential threats through legal structures such as trusts and LLCs.

Benefits of Comprehensive Private Wealth Management for Individuals

Private wealth management offers several benefits to individuals looking to grow and protect their wealth effectively. Some of the key benefits include:- Personalized guidance: Working with a dedicated wealth manager who understands your unique financial situation and goals.

- Professional expertise: Access to a team of financial experts with specialized knowledge in investments, tax planning, and other areas.

- Holistic approach: Addressing all aspects of your financial life, from investments to estate planning, to ensure a cohesive and strategic wealth management plan.

- Peace of mind: Knowing that your financial affairs are being managed proactively and professionally, allowing you to focus on other aspects of your life.

Selecting an Elite Wealth Advisor

When it comes to managing your private wealth, selecting the right advisor can make a significant difference in achieving your financial goals. It is crucial to vet a wealth advisor properly to ensure they have the expertise and qualifications to meet your needs.

When it comes to managing your private wealth, selecting the right advisor can make a significant difference in achieving your financial goals. It is crucial to vet a wealth advisor properly to ensure they have the expertise and qualifications to meet your needs.

Criteria for Evaluating an Elite Wealth Advisor

- Experience: Look for a wealth advisor with a proven track record of success in managing assets similar to yours.

- Reputation: Research the advisor's reputation in the industry and among clients to ensure they have a good standing.

- Communication: Choose an advisor who communicates clearly and regularly with you about your investments and financial plan.

- Fee Structure: Understand how the advisor is compensated and ensure it aligns with your interests.

- Client Focus: Select an advisor who puts your needs and goals first, providing personalized advice and solutions.

Qualifications and Certifications to Look for in a Wealth Advisor

- Certified Financial Planner (CFP): A CFP designation signifies that the advisor has met rigorous education and experience requirements in financial planning.

- Chartered Financial Analyst (CFA): A CFA designation indicates expertise in investment management and analysis.

- Fiduciary Duty: Find an advisor who operates under a fiduciary standard, meaning they are obligated to act in your best interest at all times.

- Educational Background: Consider the advisor's educational background, including degrees in finance, economics, or related fields.

- Professional Memberships: Look for advisors who are members of reputable organizations such as the Financial Planning Association or the CFA Institute.

Researching Wealth Management Firms Near You

When it comes to choosing a wealth management firm, proximity can play a significant role in the decision-making process. Researching wealth management firms near you allows for easier communication, in-person meetings, and a better understanding of local market conditions.

When it comes to choosing a wealth management firm, proximity can play a significant role in the decision-making process. Researching wealth management firms near you allows for easier communication, in-person meetings, and a better understanding of local market conditions.

Significance of Choosing a Firm Located Nearby

- Accessibility: Being able to meet with your advisor in person can foster a stronger relationship and enhance communication.

- Local Expertise: A firm located nearby may have a better understanding of the local market, regulations, and opportunities.

- Convenience: Quick access to your advisor can be beneficial in times of urgent financial decisions or market changes.

Advantages of Local Wealth Management Firms vs. Remote Ones

- Personalized Service: Local firms may offer more personalized service tailored to your specific needs and goals.

- Community Connections: A local firm may have established connections within the community that can benefit your financial planning.

- Face-to-Face Meetings: The ability to have face-to-face meetings can foster trust and a deeper understanding of your financial situation.

- Market Knowledge: Local firms may have a better grasp of regional market trends and opportunities that can benefit your investment strategy.

Assessing the Reputation and Track Record

When it comes to selecting a wealth management firm, assessing the reputation and track record is crucial to ensure you are entrusting your financial well-being to a trustworthy and reliable advisor.Assessing Reputation

One way to assess the reputation of a wealth management firm is to research online reviews and ratings. Look for feedback from current and former clients to get an idea of their experiences with the firm. Additionally, check if the firm has any disciplinary actions or complaints filed against them with regulatory bodies.

Reviewing Track Record and Client Testimonials

- Reviewing a firm's track record involves evaluating their performance over time. Look at their historical investment returns, client retention rates, and any awards or recognitions they have received.

- Client testimonials can provide valuable insights into the firm's level of service and expertise. Reach out to current clients or ask the firm for references to get a better understanding of what it's like to work with them.

Verifying Legitimacy and Credibility

- Check if the firm is registered with the appropriate regulatory bodies and if their advisors are properly licensed and credentialed.

- Look for any affiliations or memberships with reputable industry organizations that uphold high ethical standards.

- Ask about the firm's fee structure and how they are compensated to ensure transparency and avoid potential conflicts of interest.

Understanding Fee Structures and Services Offered

When selecting a wealth management firm, it is crucial to understand the fee structures and services offered to ensure that they align with your financial goals and needs.Fee Structures

- Percentage of Assets Under Management (AUM): This fee structure involves a percentage of the total assets managed by the firm. It incentivizes the advisor to grow your portfolio as their fees increase with the value of your assets.

- Hourly or Fixed Fee: Some firms charge an hourly rate or a fixed fee for their services. This can be beneficial for individuals with smaller portfolios or specific financial needs.

- Commission-Based: Advisors receive compensation through commissions on financial products they sell. While this may lead to conflicts of interest, it can be suitable for individuals who prefer this payment model.

Services Offered

- Financial Planning: Comprehensive analysis of your current financial situation, goal setting, and development of a personalized financial plan.

- Investment Management: Portfolio management, asset allocation, and investment selection to help you achieve your financial objectives.

- Estate Planning: Strategies to protect and distribute your wealth according to your wishes, minimizing taxes and ensuring a smooth transfer of assets.

It is essential to align the fee structures with the services needed to ensure that you are receiving value for the costs incurred.

Closure

In conclusion, Comprehensive Private Wealth Management Near Me: How to Vet an Elite Advisor has shed light on the importance of vetting elite wealth advisors and the significance of researching local wealth management firms. By understanding fee structures and services offered, individuals can make informed decisions to secure their financial future.

Expert Answers

How do I evaluate an elite wealth advisor?

To evaluate an elite wealth advisor, consider their qualifications, certifications, track record, and client testimonials.

What are the benefits of comprehensive private wealth management?

Comprehensive private wealth management offers tailored services, personalized financial planning, and strategic investment advice.

Why is it important to align fee structures with services needed?

Aligning fee structures with services needed ensures that individuals pay for services that are essential to their financial goals.