Private Wealth Management Near Me: Evaluating Boutique Firms vs. Global Banks sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with casual formal language style and brimming with originality from the outset.

As we delve into the comparison between boutique firms and global banks in the realm of private wealth management, a nuanced exploration awaits, shedding light on the intricacies of these financial service providers.

Understanding Private Wealth Management

Private wealth management involves the professional management of assets, investments, and financial planning for high-net-worth individuals, families, or organizations. These services are tailored to meet the specific needs and goals of clients with significant wealth.Primary Services Offered

Private wealth management firms offer a range of services, including investment management, financial planning, estate planning, tax planning, risk management, and retirement planning. These services are personalized to align with the client's financial objectives and risk tolerance.- Investment Management: Developing and managing investment portfolios to grow wealth over time.

- Financial Planning: Creating a comprehensive financial plan that addresses short-term and long-term goals.

- Estate Planning: Ensuring a smooth transfer of assets to future generations while minimizing taxes.

- Tax Planning: Strategizing to optimize tax efficiency and minimize tax liabilities.

- Risk Management: Implementing strategies to protect wealth from market volatility and unforeseen events.

- Retirement Planning: Planning for a financially secure retirement by setting aside funds and managing investments.

Target Clients

Private wealth management services are typically targeted towards individuals or families with a high net worth, significant assets, or complex financial situations. These clients may require specialized expertise and personalized guidance to manage their wealth effectively.Evaluating Boutique Firms vs. Global Banks

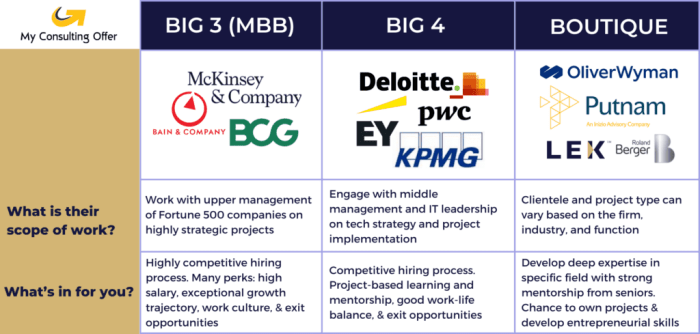

When it comes to choosing between boutique firms and global banks for private wealth management, it's essential to consider the key differences in their approaches and offerings. Boutique firms often provide a more personalized approach to wealth management, offering tailored solutions based on individual client needs and preferences. This level of customization allows clients to have a more hands-on experience and a closer relationship with their financial advisor. On the other hand, global banks typically have extensive resources and a wide range of financial products and services to offer. While they may not provide the same level of personalized attention as boutique firms, they can provide access to a diverse array of investment opportunities and sophisticated financial tools.Personalized Approach of Boutique Firms

Boutique firms pride themselves on offering a personalized approach to wealth management, taking the time to understand each client's unique financial goals and risk tolerance. This level of customization can lead to tailored investment strategies that align with the client's objectives.- Boutique firms often have a smaller client base, allowing for more individualized attention and a closer relationship between the client and their advisor.

- Advisors at boutique firms may have a deeper understanding of their clients' financial situations and can provide more targeted advice and recommendations.

- Clients may have more input and control over their investment decisions, leading to a greater sense of involvement in the wealth management process.

Extensive Resources of Global Banks

Global banks have the advantage of vast resources and a broad network of experts, which can provide clients with access to a wide range of financial products and services. While the approach may be more standardized, clients benefit from the bank's global reach and comprehensive capabilities.- Global banks offer a diverse selection of investment opportunities, including access to exclusive products and services not available at boutique firms.

- Clients may benefit from the bank's research and analysis capabilities, which can help inform investment decisions and strategies.

- Global banks often have a strong regulatory framework and compliance standards in place, providing clients with a sense of security and stability.

It's essential for investors to consider their individual needs and preferences when choosing between boutique firms and global banks for wealth management.

Services Offered by Boutique Firms

When it comes to boutique wealth management firms, they often provide specialized services tailored to meet the unique needs of individual clients. These firms typically focus on personalized attention and customized solutions, setting them apart from larger global banks.Specialized Services Provided by Boutique Wealth Management Firms

- Personalized Financial Planning: Boutique firms take the time to understand each client's financial goals and create a comprehensive plan to help them achieve their objectives.

- Estate Planning and Trust Services: These firms often offer expertise in estate planning, helping clients protect and transfer their wealth to future generations.

- Alternative Investments: Boutique firms may provide access to unique investment opportunities such as private equity, hedge funds, and real estate investments.

Investment Strategies Employed by Boutique Firms

- Active Portfolio Management: Boutique firms typically take a hands-on approach to managing client portfolios, making strategic adjustments based on market conditions and individual client needs.

- Diversification: These firms often emphasize diversification across asset classes and investment styles to help reduce risk and maximize returns.

- Long-Term Focus: Boutique firms tend to focus on long-term investment strategies that align with the client's financial goals and risk tolerance.

How Boutique Firms Tailor Their Services to Meet Individual Client Needs

- Customized Investment Plans: Boutique firms work closely with clients to develop personalized investment plans that align with their unique financial objectives and risk tolerance.

- Regular Communication: These firms emphasize regular communication with clients to provide updates on their portfolios, discuss any changes in the market, and address any questions or concerns.

- Flexibility and Adaptability: Boutique firms are known for their ability to adapt quickly to changing market conditions and client needs, ensuring that investment strategies remain relevant and effective.

Services Offered by Global Banks

When it comes to private wealth management, global banks offer a wide range of services to cater to high-net-worth individuals. These services are designed to provide comprehensive financial solutions and personalized advice to meet the diverse needs of their clients.

When it comes to private wealth management, global banks offer a wide range of services to cater to high-net-worth individuals. These services are designed to provide comprehensive financial solutions and personalized advice to meet the diverse needs of their clients.

Range of Services

- Investment Management: Global banks offer professional portfolio management services, including asset allocation, risk assessment, and investment strategies tailored to individual client goals.

- Estate Planning: They provide expertise in estate planning, trust services, and tax-efficient strategies to help clients preserve and transfer their wealth to future generations.

- Financial Planning: Global banks offer holistic financial planning services, including retirement planning, education funding, and cash flow management to ensure long-term financial security.

Technology and Tools

- Digital Platforms: Global banks utilize advanced digital platforms to provide clients with real-time access to their accounts, investment performance, and financial planning tools.

- Risk Assessment Tools: They use sophisticated risk assessment tools to analyze client portfolios and ensure alignment with risk tolerance and investment objectives.

- Client Relationship Management: Global banks employ CRM systems to enhance client communication, track interactions, and provide personalized service based on client preferences.

Key Differences

- Global Reach: Global banks have a vast international network, allowing them to offer cross-border services and access to global investment opportunities that boutique firms may not have.

- Specialized Expertise: Global banks often have specialized teams of wealth management professionals with expertise in various financial areas, providing clients with a wide range of specialized services.

- Comprehensive Solutions: Global banks offer a one-stop-shop for all financial needs, including banking services, lending solutions, and investment management, providing clients with a comprehensive suite of services under one roof.

Last Word

In conclusion, the evaluation of boutique firms versus global banks in private wealth management unveils a landscape rich in choices and considerations. Whether opting for personalized attention from boutique firms or the extensive resources of global banks, individuals navigating the world of wealth management are presented with a myriad of options tailored to their specific needs and preferences.

FAQ

What are the primary services offered by private wealth management firms?

Private wealth management firms typically offer services such as investment management, financial planning, estate planning, and tax optimization tailored to high-net-worth individuals.

How do boutique firms differ from global banks in wealth management services?

Boutique firms focus on personalized attention and customization, while global banks offer extensive resources and a wide range of financial products and services.

What are some examples of specialized services provided by boutique wealth management firms?

Specialized services from boutique firms may include family office services, alternative investments, philanthropic planning, and legacy planning.