Why Ultra High Net Worth Wealth Management Requires a Global Family Office Structure sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset.

Exploring the intricate balance between global family office structures and managing ultra high net worth wealth, this topic delves into the complexities of modern wealth management with insightful perspectives.

Importance of Global Family Office Structure

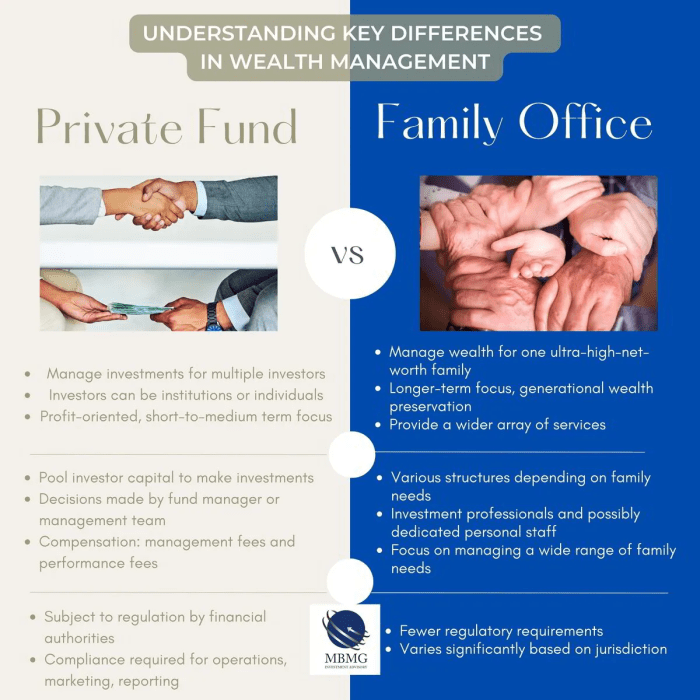

Managing ultra high net worth wealth requires a sophisticated approach that goes beyond traditional wealth management practices. A global family office structure is crucial in this context as it provides a comprehensive and integrated framework to effectively handle the complexities of vast wealth.

Benefits of Global Family Office Structure in Wealth Management

- Diversification: A global family office allows for diversification across various asset classes and geographies, reducing risk and enhancing returns.

- Customized Solutions: Tailored wealth management solutions that cater to the unique needs and objectives of ultra high net worth individuals and families.

- Access to Global Opportunities: The structure provides access to a wide range of global investment opportunities, ensuring a well-rounded portfolio.

- Risk Management: Robust risk management strategies are implemented to protect and preserve wealth in the face of market fluctuations and uncertainties.

Advantages of Global Family Office Structure over Traditional Wealth Management Approaches

- Holistic Approach: Global family offices take a holistic view of wealth management, considering not just financial assets but also family values, legacy planning, and philanthropic goals.

- Expertise and Specialization: Specialized teams within the family office offer expertise in various areas such as tax planning, estate management, and investment advisory, ensuring a high level of service.

- Confidentiality: Family offices provide a high degree of confidentiality and privacy in managing sensitive financial matters, safeguarding the family's interests.

- Cost Efficiency: While initially expensive to set up, global family offices can be cost-effective in the long run by optimizing investment strategies and minimizing unnecessary expenses.

Key Components of Ultra High Net Worth Wealth Management

Ultra high net worth wealth management involves a combination of strategies and practices tailored to the unique needs of individuals with substantial assets. Let's delve into the key components that make up ultra high net worth wealth management.Role of Diversification within a Global Family Office Structure

Diversification plays a crucial role in managing the vast wealth of ultra high net worth individuals within a global family office structure. By spreading investments across different asset classes, regions, and industries, diversification helps mitigate risks and enhances the potential for returns. This approach ensures that the wealth is not overly exposed to the fluctuations of any single market or sector, providing stability and long-term growth opportunities.Importance of Risk Management Strategies in Ultra High Net Worth Wealth Management

Effective risk management is paramount in ultra high net worth wealth management to safeguard and grow assets over time. This involves identifying and assessing risks, developing strategies to mitigate them, and monitoring the portfolio regularly to adapt to changing market conditions. By implementing robust risk management strategies, ultra high net worth individuals can protect their wealth from potential threats and capitalize on opportunities in a controlled manner.Challenges and Solutions

Managing ultra high net worth wealth comes with its own set of challenges that require strategic solutions for effective wealth management.

Complexities of Global Family Office Structures

Global family office structures can present various challenges due to the diverse nature of assets and investments spread across different regions.

- Coordination and Communication: Ensuring seamless coordination and communication among family members, advisors, and stakeholders across multiple locations can be a challenge.

- Tax and Legal Compliance: Navigating through complex tax regulations and legal requirements in various jurisdictions can be overwhelming.

- Risk Management: Identifying and managing risks associated with global investments and market fluctuations requires a comprehensive risk management strategy.

- Cultural and Language Barriers: Dealing with cultural differences and language barriers in international dealings can hinder effective decision-making.

Role of Technology in Addressing Challenges

Technology plays a crucial role in addressing the challenges faced in ultra high net worth wealth management within a global family office structure.

- Integrated Wealth Management Platforms: Utilizing advanced wealth management platforms can streamline financial data and reporting, enhancing transparency and efficiency.

- Data Analytics and AI: Leveraging data analytics and artificial intelligence can provide valuable insights for better investment decisions and risk management.

- Cybersecurity Measures: Implementing robust cybersecurity measures is essential to safeguard sensitive financial information and protect against cyber threats.

- Virtual Collaboration Tools: Using virtual collaboration tools can facilitate real-time communication and collaboration among family members and advisors, irrespective of geographical locations.

Succession Planning

Succession planning is a critical aspect for ultra high net worth families to ensure the continuity and preservation of wealth across generations. It involves creating a strategic roadmap for transitioning leadership and ownership of assets to heirs or designated individuals in a seamless manner.Importance of Succession Planning

- Preservation of Wealth: Succession planning helps in preserving the family's wealth by establishing clear guidelines on how assets will be managed and distributed in the future.

- Family Harmony: By addressing potential conflicts and setting expectations early on, succession planning can promote family harmony and reduce disputes among heirs.

- Business Continuity: For families with businesses, succession planning ensures a smooth transition of leadership to maintain the operations and growth of the enterprise.

- Tax Efficiency: Proper succession planning can help minimize tax liabilities for the family and heirs, optimizing the transfer of wealth.

Facilitating Succession Planning with a Global Family Office Structure

- Centralized Coordination: A global family office structure provides centralized oversight and coordination of all financial affairs, making it easier to implement and monitor succession plans.

- Expertise and Guidance: Family office professionals have the expertise to guide families through complex succession planning processes, ensuring compliance with legal and tax regulations.

- International Reach: With a global network, family offices can assist in managing assets across different jurisdictions, addressing cross-border complexities in succession planning.

Best Practices for Successful Generational Wealth Transfer

- Start Early: Begin succession planning as soon as possible to allow for adequate time to address all aspects of wealth transfer and family governance.

- Communicate Effectively: Open and transparent communication among family members is key to successful succession planning, fostering understanding and alignment on future goals.

- Regular Reviews: Periodically review and update the succession plan to adapt to changing circumstances, ensuring its relevance and effectiveness over time.

- Professional Guidance: Seek the expertise of advisors, including legal, financial, and tax professionals, to navigate the complexities of succession planning and ensure a comprehensive strategy.

Ultimate Conclusion

In conclusion, the necessity of a global family office structure in ultra high net worth wealth management cannot be overstated. It is the linchpin that ensures effective management and strategic planning for generational wealth preservation. As the financial landscape evolves, embracing this structure becomes increasingly vital for sustaining and growing substantial wealth.

Answers to Common Questions

What are the benefits of a global family office structure?

A global family office structure provides centralized oversight and coordination of various wealth management activities across multiple jurisdictions, ensuring efficient management and strategic decision-making.

How does diversification play a role in ultra high net worth wealth management within a global family office structure?

Diversification helps mitigate risks and maximize returns by spreading investments across different asset classes and regions, a crucial strategy within a global family office structure to safeguard wealth.

What challenges are commonly faced in managing ultra high net worth wealth, and how can they be overcome within a global family office structure?

Challenges such as succession planning, tax optimization, and regulatory compliance can be addressed through comprehensive strategies and expert guidance within a global family office structure.